What is a Wealth Report?

The Wealth Report is a valuable financial planning tool used by Financial Advisers across Australia. It assesses your current financial position and future goals to create a comprehensive report that includes your net worth, financial health assessment, retirement cash flow projections, and more.

See for yourself

What you get with a Wealth Report

Personalised report

Whether you’re married, single or preparing for retirement, all the data you enter is used to calculate and build a unique Wealth Report based on your personal circumstances.

Obligation & cost-free

That’s right – It’s free to use! No trial periods or subscription fees. Create a Wealth Central Account and when you’re ready, you can download a personalised Wealth Report at any stage in the process.

See future projections

Can you afford that renovation? What should I do with excess savings? Add in goals and scenarios to see how you’ll be financially in 5 years or at retirement with industry-leading modelling to project your future.

Wealth of discovery

No need for calculators; Wealth Central will crunch the numbers for you! Enter your information once to discover your net worth, future wealth, and how long your money will last into retirement.

Getting started with Wealth Central

To create a Wealth Report, you’ll first need to create an account and log into Wealth Central – the platform you will use to build your report. The whole process is simple, fun and can be done in under 20 minutes.

When you’re done, simply generate and download your Wealth Report.

FAQ’s

You probably still have a lot of questions. That’s understandable. To help, we’ve put together some frequently asked questions people have about using the Wealth Central tool.

Why is it free?

It’s all part of the service. At Finspective, we believe in providing people with the tools and know-how to control their future and achieve financial freedom. Not only is it free, but you have no obligation to take further steps after receiving your Wealth Report document. We want you to feel comfortable before seeking advice.

Is there any further advice available?

Certainly, that’s what we are here for. You can ask simple questions through the app at any stage, and one of our advisers will get back to you with an answer. If you’re looking for more detailed advice, booking a face-to-face chat is always best. Don’t worry; the first consultation is always free. You can book a quick chat with one of our advisers using this link.

What will Wealth Central include?

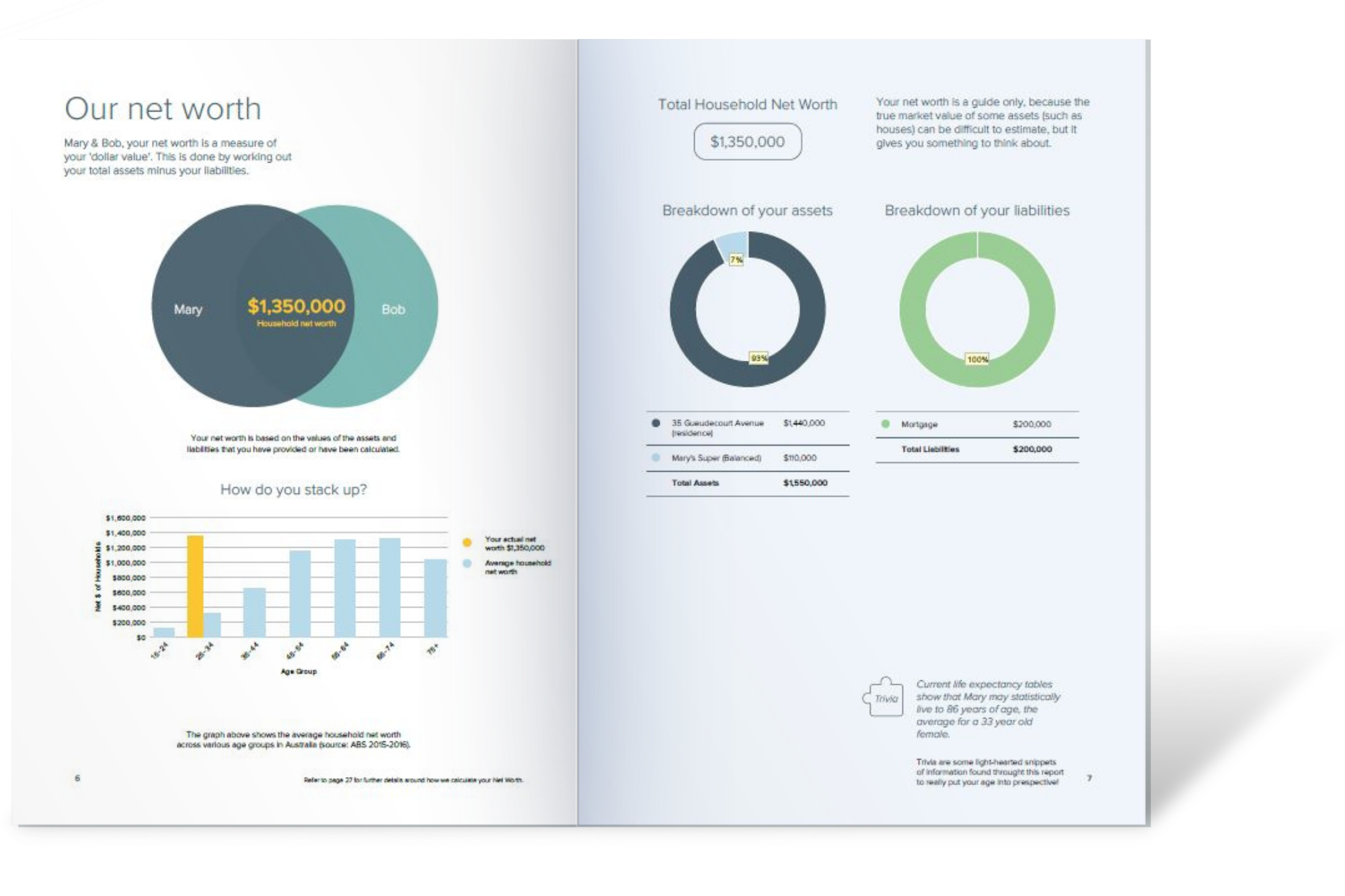

When you’re done populating all your data, you can download your Wealth Report, which has over 20 pages of personalised data. The document includes but is not limited to, a comparison to others of your age, a summary of your current finances, your net worth, future projections at retirement based on assumptions, and even a property value estimation. Check out this Example Wealth Report document.

Is my data secure?

Completely! You can feel confident your information remains confidential and secure. The site owner, Wealth Central Pty Ltd. ACN 158 016 258, uses the same encryption and physical security banks use to protect your details. We cannot view your personal information unless you select the option to allow a qualified financial advisor from our team to view your data and contact you to discuss the outcomes.

Why use Wealth Central?

Well, besides being a really neat piece of technology, we also think it’s a great place to start for anyone looking to improve their financial resolve. While there are plenty of other apps and templates out there, we think this one is the best – hands down. Investment Trends even awarded it the Best New Advice Technology Application.

Is it easy to use?

Totally. We like to call the process – the Wealth Game! It’s a simple drag-and-drop platform with easy to understand icons. Check out the video above to see how it works.

How long does it take?

You can get a lot done in 5-10 minutes and view a partial report at any time during the process. However, for a complete and detailed Wealth Report, populating all fields should take around 20 minutes, depending on your family size and circumstances.

Can I save and come back to answer any questions later?

Yes. One of the best things about this is that you can save your progress by creating a login and password at any stage. This allows you to come back and complete any parts later.

What if my financial circumstances change?

That’s ok. If your circumstances change, you can simply log back in and update your data. From there, you can recreate your Wealth Report document. It is recommended you speak to your advisor at this stage.

Why is it better than the other sites?

Other sites ask you to fill out many different calculators; superannuation calculators, mortgage calculators, pension calculators. With Wealth Report’s integrated approach, fill out your information once, and it will apply all the appropriate calculators to fit your life.

Who should use Wealth Report?

Anyone looking to better understand their financial future—not just those looking to retire in the near future, but young families and singles—will benefit greatly. It is always better to understand your financial progress sooner rather than later. Time is a powerful tool.