Avoid the Home Loan Mortgage Rate Cliff

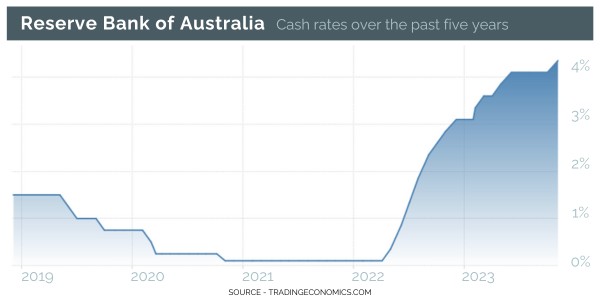

Two years ago, fixed rates were reduced to levels not seen in decades, giving home loan borrowers access to rates around 2 per cent and below. Since then, there has been a considerable shift in the interest rate landscape with the Reserve Bank of Australia lifting the cash rate from a historic low of 0.1 per cent to 4.1 per cent within 13 months.

While the strain from interest rate hikes has impacted many, homeowners who fixed their loan in 2020-2021 are facing hundreds, and in many cases thousands, of dollars extra a month in repayments once they roll off their fixed rate.

RBA data shows there were 590,000 mortgages that came off fixed rates in 2022, and there will be 880,000 in 2023 and 450,000 in 2024.

If your fixed rate home loan is ending, there are practical things you can do now to prepare and understand what is going to occur.

Reversion to Standard Variable Rate:

When your home loan expires, it typically reverts to your lender’s standard variable rate, which may be higher than the fixed rate you were previously paying.

Loyalty Tax:

Some lenders may not offer existing customers the same rates as new customers, which can result in higher rates for loyal customers. This is sometime referred to as a “loyalty tax” and isn’t isolated to your home loan.

Creating a Buffer:

Consider creating a financial buffer by analysing your future repayments and lifestyle. You can make extra repayments if your lender allows, which can help you simulate the higher repayments you’ll face in the future. You need to consider the consequences of making extra repayments to your fixed rate, such as not being able to access those funds until the fixed rate expires.

Negotiate with Current Lender:

Contact your current lender to negotiate a better rate before automatically rolling over to the standard variable rate. Requesting a discharge form can signal your intention to leave and may prompt your lender to offer a better deal than they originally did.

Refinance with a new lender:

If your current lender doesn’t offer a competitive rate, explore the option of refinancing with a new lender. Be mindful of potentials costs like Lenders Mortgage Insurance and exit fees before pulling the trigger and remembering, banks are showing more support to the “Mortgage Prisoner”. I covered this in an article last month.

Contact the Lender’s Financial Hardship team:

If you’re concerned about your ability to make higher repayments, reach out to your lender’s financial hardship team early. They may offer solutions such as payment plans or converting to interest-only repayments. Beware, these alternate arrangements with your lender may be recorded in your credit report which could impact your ability to secure credit in the future.

Consider Selling the Asset:

In extreme cases where you can’t afford the higher mortgage repayments, you may need to consider selling the property before the bank takes control. This can help you avoid additional legal and bank fees, which means you walk away with more cash than you otherwise would have.

It’s crucial for homeowners to plan and make informed decisions as their fixed rate terms come to an end to ensure they can manage their mortgage payments effectively. Consulting with a financial advisor or mortgage broker can also be helpful in navigating these decisions.

If you feel like you deserve a better deal on your home loan, check out our Home Loan Refinancing page and see how our lending specialists can help.

Any advice on this site is general nature only and has not been tailored to your personal objectives, financial situation and needs. Please seek personal advice prior to acting on this information. Any advice on this website has been prepared without taking account of your objectives, financial situation or needs. Because of that, before acting on the advice, you should consider its appropriateness to you, having regard to your objectives, financial situation or needs.