The conversation took a turn when I asked them about their home. They’d bought it years ago, and while they acknowledged that property prices in Jan Juc had dipped about 10% recently, they were still significantly ahead compared to when they first bought it.

It clicked for them. If they had kept their money in cash instead of buying a home, they would never have experienced the volatility of recent times—but they also wouldn’t have seen the long-term growth. The same principle applies to investing in growth assets, including via superannuation. Short-term market fluctuations may cause anxiety, but history shows that staying invested yields better results.

When it comes to investing, people love to argue over active versus passive investing, pick apart the latest market trends, and stress about finding the next big winner. But in my experience, these debates overlook the most important factor—your investment timeframe.

Your number one question should not be “What should I invest in?” or “What are the fees?” it should be,

“How long can I leave this money (or a portion of it) alone?”

I didn’t just come up with this idea. It’s backed by decades of market data, research, and common sense. If you’re investing for the short term, volatility is your biggest enemy. But the whole game changes if you’ve got time on your side.

Why Timeframe Matters More Than Diversification or Investment Style

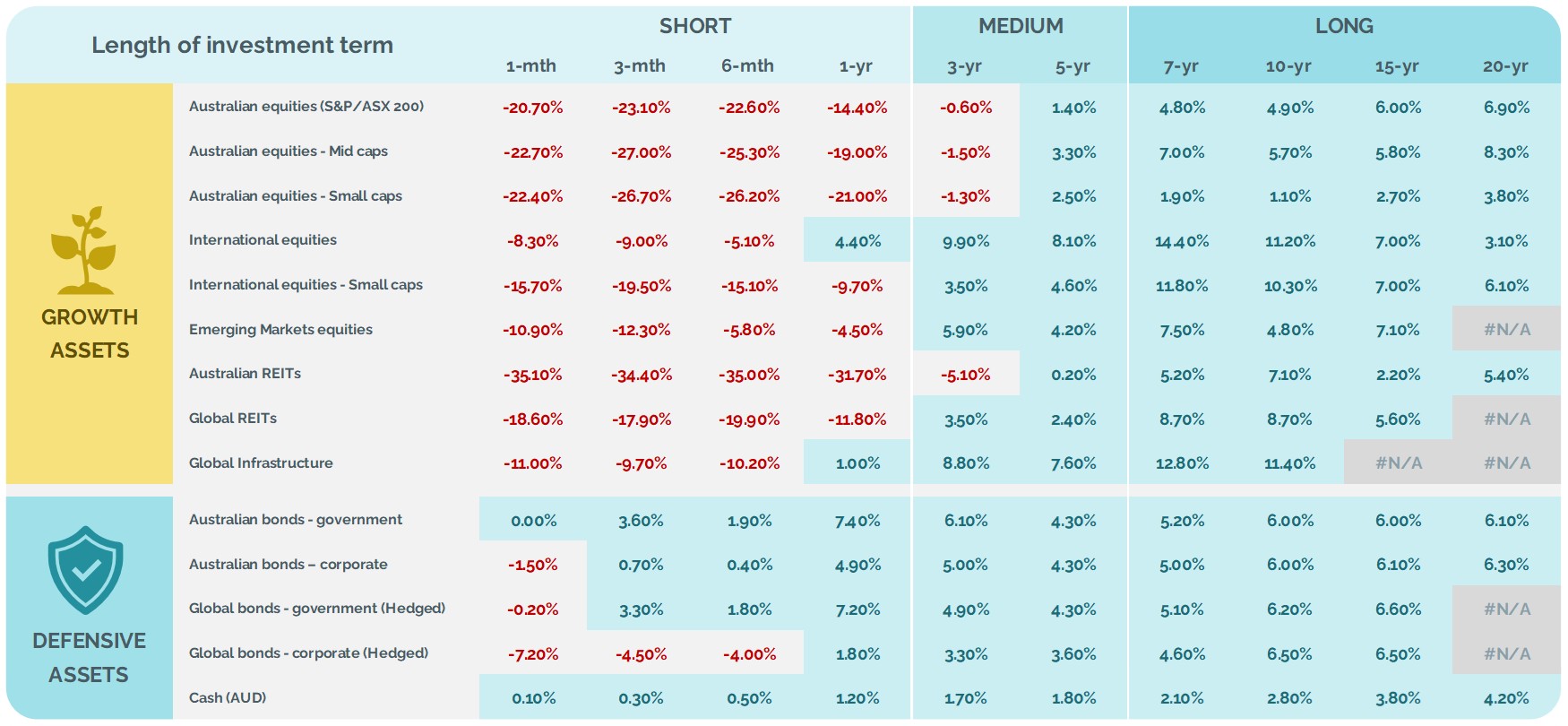

I share this chart with clients weekly. It shows the 20-year asset class performance from April 2000 to March 2020. I chose March 2020 because it was when investment markets fell dramatically due to the COVID-19 pandemic. The 20-year timeframe also accounts for other major financial events including the Global Financial Crisis and the September 11 attacks.

Long-term asset class performance to March 2020 (Total returns in AUD)

* AUD total returns as at Mar-20 assuming reinvestment of dividends

** Returns reflect index performance excluding any fees; Actual ETF/managed fund performance will vary due to both fees and tracking error.

Don’t get me wrong—diversification is useful. So is the whole active versus passive debate. But neither of them has as much impact as your investment timeframe.

A well-diversified portfolio won’t save you if you need to cash out during a downturn. If you’re forced to sell, a 30% drop in equities is still a 30% drop, no matter how carefully you spread your investments. Similarly, short-term market movements will still affect you whether you choose an active or passive approach. Your timeframe dictates how much risk you can handle—and that’s what really matters.

The Brinson study also showed that security selection (picking individual stocks) and market timing have almost no impact on long-term investment success. Trying to pick winners or time the market perfectly? It’s a losing battle. A well-structured portfolio aligned with your timeframe is a far better bet.

Test the statistics! Go to your super fund’s website and check out the best-performing long-term investment option. It will not be the one with a high exposure to cash, government bonds, or other defensive assets.

The Cost of Avoiding Growth Assets

Playing it too safe can be just as risky. Sticking to cash and defensive assets might feel comfortable, but it comes at a cost—you risk not growing your money enough to keep up with inflation or fund your long-term goals.

The couple in Jan Juc had to consider this as well. If they moved all their super into cash to avoid volatility, they’d essentially be locking in lower returns. Over the next 20 years, that could mean running out of money sooner than expected. Instead, they realised that a reasonable allocation to growth assets was just plain smart to ensure their funds lasted through retirement.

Here’s a simple example: A $500,000 investment growing at 5% annually would be worth around $1.32 million after 20 years. Increase that return to 6%, and it jumps to over $1.6 million. That’s a game-changer when it comes to financial security, retirement, or reaching your financial goals faster.

Many people think avoiding risk is the safest option. But the real risk… Missing out on the power of long-term compounding. Markets recover. Investors who stay the course tend to come out ahead.

Fees: A Factor, But Not the Most Important One

Fees are often overemphasised in investment decisions. Sure, keeping costs reasonable is smart, but what really matters is your return after fees. A slightly higher-cost investment that delivers better long-term performance beats a low-cost one that underperforms. Net returns should always be the focus, not just fees.

Test the theory for yourself by looking at your own super fund: the best-performing investment option over the long term is unlikely to also be the cheapest.

How to Apply This in Real Life

So, what does this mean for you? If you’re a first-home buyer saving for a deposit in the next two years, steer clear of growth assets. The last thing you want is for your savings to shrink just before you need them. Cash and defensive assets are the way to go.

But if you’re a retiree planning to make your money last for 20+ years, you still need to allocate a prudent portion to growth, particularly the portion that will not be ‘touched’ for the long term. The old-school idea that retirees should avoid risk ignores the reality that avoiding growth investments can leave you short in the long run.

The Bottom Line: Align Your Investments with Your Timeframe. Get that right, and everything else—diversification, investment style, asset selection—will fall into place. Long-term investing is a marathon, not a sprint; your best chance of success is ensuring your strategy matches your timeframe.

If you’re after a Financial Adviser that will guide your investment years and wealth creation strategies, Finspective can help. Check out our Investing & Wealth Creation page for more information.

Any advice on this site is general nature only and has not been tailored to your personal objectives, financial situation and needs. Please seek personal advice prior to acting on this information. Any advice on this website has been prepared without taking account of your objectives, financial situation or needs. Because of that, before acting on the advice, you should consider its appropriateness to you, having regard to your objectives, financial situation or needs.