Buying gifts and hosting a cheeky little Christmas party for staff or clients is a great way to conclude a busy and successful year, even more so when it’s all tax-deductible. Well, before you lock in that party venue or bulk purchase gifts, you may want to revisit the ATO guidelines and consider the tax implications—specifically around Finge Benefits Tax (FBT) and the tax deductibility on Christmas parties.

As a business owner myself, every year I look forward to celebrating with my team. Hosting a party or giving gifts is a great way to foster a positive work culture, reward loyalty, and create an environment where staff feel valued and motivated. I find it’s also an opportunity to show gratitude towards clients, strengthen relationships, and ultimately, encourage future referrals and business. It’s more than just tradition—it’s a strategic investment in people and partnerships.

That said, no one wants a surprise tax Grinch ruining your Christmas vibe!

Which brings us to the reason I’m writing this—to help you plan and avoid unexpected tax costs come Christmas. So, to spread some cheer, I want to share a very handy document that covers the importance of things like client ‘entertainment’ meetings, what’s a tax-deductible gift, and avoiding Christmas party FBT and income tax.

Before you jump in, below is a quick look at some of the basics, including how to avoid an unpleasant tax surprise. When you’re ready, download our Tax Queries – Business Claims guide and start planning a tax-savvy festive season.

So, are Christmas parties & gifts tax-deductible?

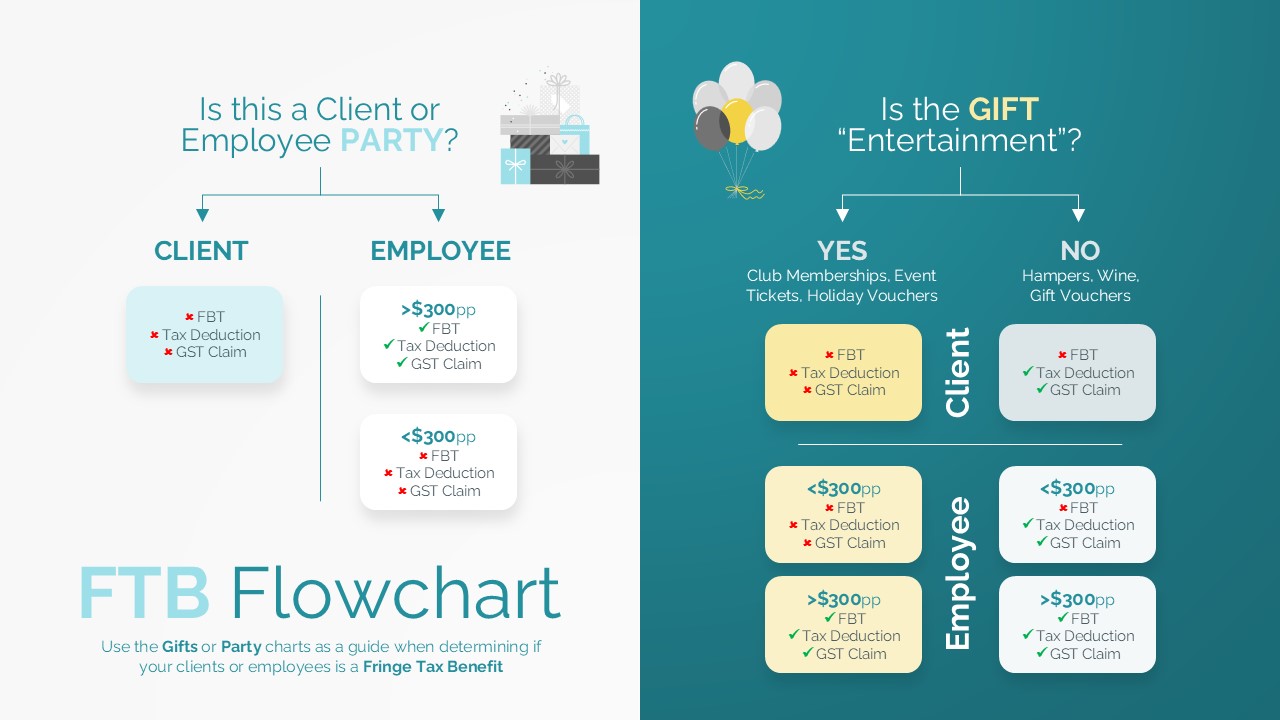

The ATO has specific rules about what is and isn’t tax-deductible regarding gifts and parties. Getting it wrong could lead to extra tax bills or lost deductions. Here are a couple of key tips:

- Christmas Party FBT: For a party on a regular workday, if the event is held on your business premises and attended only by your current employees, no FBT will apply to the food and drink provided. If the event takes place off-site or includes associates of employees (e.g., their partners), FBT does not apply if the cost per person is under $300. For events that include clients, FBT does not apply to costs associated with the clients.

- Christmas Party Tax Deduction: If the Christmas party is not subject to FBT, you can’t claim income tax deductions for the cost of the party.

- Gifts for Staff: Gifts that cost $300 or more, which are considered “entertainment” (tickets to the theatre, sporting events, concerts, etc.), and provided to employees will be subject to FBT and will also be tax deductible. Gifts that cost less than $300 are not subject to FBT but they are also NOT tax deductible.

- Gifts to Clients or Customers: Entertainment gifts provided to clients or suppliers are not subject to FBT and are also not tax deductible. This is regardless of value.

- Non-Entertainment Gifts: Gifts such as hampers, gift cards, or skincare sets will be tax deductible (regardless of value). FBT will apply if these gifts cost $300 or more. Gifts of this nature to clients or suppliers will be tax deductible and no FBT will apply regardless of value.

Don’t Let the FBT Grinch Sneak Up on You

FBT and income tax can quickly turn generosity into a costly misstep if you’re not across the details:

- A lavish off-site party exceeding $300 per head? That’s Christmas Party FBT territory for employees and their families.

- Want to thank your referring clients with an intent to drum up further business? Stick to non-entertainment gifts, like vouchers, to avoid unexpected taxes.

The good news is, with a little planning, you can celebrate the holiday season while keeping the ATO happy.

Before you pop the champagne, download our guide and ensure this year’s celebrations are both joyful and tax-smart. If you’re still unsure about tax treatments or structuring your office party, I’m just a call or email away.

Cheers to a festive (and FBT-free) holiday season!

If you want to optimise your tax outcomes and build your wealth for retirement at the same time, our Accounting & Tax Professionals have the skills, knowledge and tools to get you sorted.

Any advice on this site is general nature only and has not been tailored to your personal objectives, financial situation and needs. Please seek personal advice prior to acting on this information. Any advice on this website has been prepared without taking account of your objectives, financial situation or needs. Because of that, before acting on the advice, you should consider its appropriateness to you, having regard to your objectives, financial situation or needs.